Taking a look at current market data and historic trends to keep you informed on the state of our real estate market. Continued updates to come over the coming weeks.

Adding Value To Your Home

Are you considering making improvements to your property?

Before starting projects, ask yourself: “am I making updates for me or to add value to my property when I sell?”

Many homeowners think they need to undertake projects when preparing their home for the market. It takes an experienced professional to know which projects deliver value, yielding you a return on your investment and which will likely be an unnecessary expense. If you’re making improvements with the goal of increasing the value of your home please give me a call, I’d be happy to meet with you to help evaluate which projects make sense and work with you on a customized high value success plan in preparing to sell your home.

Here are the top remodeling/home maintenance projects homeowners take on with an estimated expense, reported from Homeadvisor.com and the Hanley Wood Media Inc. Cost vs Value Report (2018):

- AC replacement: $4,277

- Bathroom remodel: $19,113 (midrange), $61,703 (upscale)

- Exterior painting: $2,636 (midrange) $4,855 (upscale)

- Furnace replacement: $4,046

- Garage door replacement: $3,484

- Kitchen remodel: $21,193 (minor), $63,485 (midrange), $126,455 (upscale)

- Roof replacement: $11,250

- Water heater replacement: $1,345

- Window replacement $15,903

Do you need quality contractors to help with your improvements?

I’ve worked with many professionals and would be happy to put you in touch with reputable contractors. I know great plumbers, HVAC, handymen, interior designers, painters, housekeepers and more…

Please contact me to discuss projects you’ve been considering or if you’re looking for contractor recommendations. I’m never to busy to answer your questions and provide excellent real estate service to you and your referrals.

Buying With A House To Sell

You’re ready to move to the home you’ve been dreaming of, but unsure of the best path to take. Let’s chat about your situation to determine which option works best for you. I specialize in helping families move from their current home into the home they’ve been dreaming of, which often involves buying and selling at the same time while coordinating a door-to-door move.

Door to door move

If you’re like many homeowners, you’re interested in selling your current home to move on to the next chapter of your life BUT you’re afraid your house will sell faster then you can find your replacement home. Who wouldn’t prefer a door to door move over a temporary housing situation? Here are 4 potential solutions to help ease your anxiety and seamlessly move you from your current home to your new home.

1. Buy first. Some are fortunate enough to be in a position to buy then sell. If you don’t just have the cash lying around perhaps you have enough equity in your current home for a bridge loan toward a down payment, or you’re able to borrow money from a retirement account or receive a “gift” to be used as a down payment. Before pursuing this option be sure to speak with your lender if you’ll be financing a portion of the purchase price. There may be certain requirements that need to be met or documentation needed.

2. Rent back. If prospective buyers know up front you need to find a replacement home, many will be happy to work with you on a rent back. A number of details should be agreed upon up front between you and the Buyer if pursuing this option.

3. Extended close. Once again, if prospective buyers know up front you need to find a replacement home you may find one that would agree to a closing further out than 30 days. A number of details should be considered before entering in a contract with a prospective buyer with this option.

4. Conditional sale provision. Just like a buyer who’s contract is contingent upon the sale of their existing home, you can add language into the additional provisions of the contract providing you as the seller an out by a certain date if you haven’t successfully found your replacement home. There are likely fewer buyers who will agree to this provision, but it’s another option to weigh with your REALTOR and prospective buyer.

There are pro’s and con’s to each option. Be sure to consult with your REALTOR to discuss your options and the best way to achieve finding a buyer who is not only flexible but well qualified. For more information and a consultation on this topic, contact Jennifer Blake today!

Successful Seller: 9 Secrets Unlocked

Download your free copy of “Successful Home Seller – 9 Secrets Unlocked.” This PDF addresses things you should think through before you list your home and tips from the pro’s on maximizing your equity while minimizing stress.

Download your free copy of “Successful Home Seller – 9 Secrets Unlocked.” This PDF addresses things you should think through before you list your home and tips from the pro’s on maximizing your equity while minimizing stress.

Subscribe to Denver Real Estate News

A look at Denver Real Estate – December 2014

5 Tips for anyone Buying or Selling Real Estate in 2015

5. Translating Real Estate Predictions for 2015

Every year experts make predictions on what the future has in store, based on the many predictions I’ve seen, here’s what I see in the crystal ball most likely to affect the Denver Real Estate market. Interest rates on the rise, rates have remained in the low 4’s for the past several years and many experts predict rates will reach 5 by the end of 2015. What this means is affordability will decrease when rates increase, likely causing home values to stabilize. Record high home sales in Denver, with the combination of first time millennial buyers, growing population in Denver, move up buyers who have been waiting for their homes value to provide the equity needed for their next stage in life, empty nesters looking to downsize or move to a warmer climate, and the large number of boomerang buyers who went through a short sale or foreclosure when the market fell approximately 5 years ago – Denver will have extremely high home buyer demand in 2015 and I suspect we will see a record high number of homes sold in 2015. Increase home prices in Denver, values will likely see modest increases this year as values slow from the double digit increases we’ve seen for the past 2 years. We are still in a sellers market with more demand than availability inventory – demand is expected to stay strong in 2015 but when interest rates increase, buyers affordability will counter balance the jumps we’ve been seeing in price. Bottom line, now is a great time to buy or sell property in Colorado. Often times you move because of a life altering event and it’s a necessity, if you’ve been waiting for the right time to move there may not be a better year than 2015!

- Understanding Market Value vs Appraised Value

As a buyer or seller, it’s important to understand value is driven by a variety of factors in the market. Market value is the amount a buyer is willing to pay for a property, this is sometimes higher and sometimes less than the appraised value. In a perfect world, an appraiser will come up with a value equal or slightly higher than the purchase price. Why might a buyer be willing to pay more than similar homes recently sold for? Perhaps it’s the only house that check’s every box off your list or the house has a unique feature or desirable location that is difficult for an appraiser to justify an adjustment, or perhaps this is your favorite house and you’re up agains fierce competition with other buyers who have offers on the table. We are still in a strong sellers market, exceptional houses in certain price ranges may attract buyers who either offer more or are willing to pay more than the appraised value. This is a complicated matter that as a buyer or seller you may find yourself in and need to have a realistic idea of an estimated “appraised” value before making an offer or countering/accepting an offer.

- Strategize a Door to Door Move

No one wants to move into temporary housing. With realistic expectations paired with a smooth real estate transaction, more often than not you should be able to move directly from your current property to your desired new home. Here are several things that can assist you with a successful door to door move. 1) Have broad search criteria with a realistic price range, be looking in a several mile radius or in multiple neighborhoods with a price range that is within the “average sales price” for the area. The “average sales price” varies across the Denver Metro in some areas you can find a detached single family for $200,000-$250,000 and other areas you’ll need at least $400,000. 2) Have a realistic timeline, from contract to close you’ll typically need 4-6 weeks. In certain circumstances you can close in 2 weeks but that is not the norm. Even with a 4 week close you should plan a little buffer time to plan and prepare. 3) Work with a team of professionals. On your team it’s imperative you have an experienced REALTOR and lender (unless you’re a cash buyer). This is likely one of the largest purchases of your lifetime, do not underestimate the complexity of details involved and the unexpected turns that could happen. Your lender is just as important as your REALTOR, especially if you’ve had a credit event in recent years such as a short sale, foreclosure, NED or bankruptcy – you may be able to qualify but DO NOT take that risk with anyone other than an trusted expert in purchase loans.

- How to handle a competitive offer situation

In Denver’s currently strong sellers market, as a buyer or seller you need to be prepared for multiple offers. For a Seller, the highest offer is quite possibly not the best – let your REALTOR advise you on the various factors to evaluate to determine which Buyer is most likely to successfully close on your property. For a Buyer, first and foremost, you need to be pre-approved with a reputable local lender to be competitive. I stress pre-approved as this means your financial background has been seen and verified by your lender and you’ve gone beyond simply completing an online loan application. As mentioned previously, working with a trusted expert in purchase loans will greatly benefit you, a good listing agent will vet your lender before discussing offers with their client and be more comfortable advising the Seller to work with a lender they have a positive track record with. While there are many lenders out there, few have a highly esteemed reputation that will increase your competitiveness. Other considerations as a buyer is having tight deadlines; no contingency if possible; increasing your earnest money; making your offer stick out; and having a clean offer, you’d be surprised at the number of individuals who have a Colorado Real Estate License but do not professionally complete the Contract to Buy and Sell.

- Talking through your real estate needs and expectations

Buying or selling a house is a big decision. It’s important to understand what is motivating you to make the move, set your goals and prioritize your wish list. If you are a current homeowner, be sure your REALTOR provides you with your estimated net proceeds – based on a realistic market value for your home, this will be needed to help determine a realistic budget for your next home. Whether you’re a seasoned homeowner or a first time homebuyer be sure to work with someone who is there to understand your needs and work hard to serve YOU.

If you’ve been thinking of buying or selling a home in the Denver Metro contact me to discuss your situation and develop a plan customized to your needs. Find out the services I offer to assist my sellers earn more money in less time and my buyers increase their odds of having their offer accepted in multiple offer situations.

-Jennifer Blake, Denver REALTOR

A look at Denver Real Estate – November 2014

Despite typical seasonal cooling the Denver real estate market continues to outpace year over year demand. As seen above, available inventory of homes available for sale in the Denver Metro is nearly half of last year (source Metrolist). Most areas and price points remain in an extreme sellers market. With skyrocketing rents, growing population, record low interest rates and steady increases to the employment rate, the demand for buying property in the Denver area is high.

The average sales price has risen to $318,477 – up 8% from this time last year. In most parts of the metro this will buy you a nice detached single family home with an estimated monthly payment of $1,800 on 5% down. Average rent on a 1 bedroom apartment in Denver is currently approximately $1,300 a month and for a detached home you’re looking at $1,800 to upwards of $2,500 a month. If you’re paying more than $1,200 a month, I’d encourage you to speak with a lender to see which programs are the best fit for your qualification, set a budget and begin working with a REALTOR who can provide expert guidance on your path to home ownership. While the average sales price in Denver is currently $318,477, you can find a nice condo or townhome for approximately $150,000 – give or take depending on location and size. I’ve assisted countless first time home buyers this year who purchased a property nicer than they were renting and their payments are several hundred dollars a month less. In Aurora, Castle Rock and Thornton you can find a nice detached home for approximately $250,000. As you move into other parts of the metro such as Littleton, Arvada, Parker expect to pay approximately $300,000 for comparable homes and upwards of $400,000 to be in neighborhoods such as Platte Park, Wash Park and the Highlands.

If you’ve been thinking of buying or selling a home in the Denver area contact me to discuss your situation and develop a plan customized to your needs. Find out the services I offer to assist my sellers earn more money in less time and my buyers increase their odds of having their offer accepted in multiple offer situations.

-Jennifer Blake, Denver REALTOR

A look at Denver Real Estate – August 2014

As reported by the Wall Street Journal, home values across the country have regained momentum since the market bottomed out in 2011. Looking at the real estate Denver specifically, according to Case-Shiller, the summer of 2014 put us 10 points higher than the July 2006 recession peak. This is excellent news for homeowners who have been patiently waiting to sell their home to move on to the next chapter of their life. Many household’s have been waiting for a strong equity position to either move-up into a larger home or to downsize and use the profits for their retirement nest egg.

The current market is strong for both buyers and sellers. Buyers are able to afford more bang for their buck with historic low interest rates and sellers are able to maximize their profits with record high values.

How long before the market changes or tips in a different direction? No one knows for sure, but homeownership is part of the American Dream and it’s consistently rated as the best investment possible so I’d suggest you consider homeownership as part of a long term strategy. Not satisfied with the bureaucratic answer, here are a couple of predictions from industry analysts and experts.

1. Interest rates will reach 5% by 2015 and likely reach into the 6%’s in the foreseeable future.

2. Home values will cumulatively appreciate 19.5% by 2018. As reported by Pulsenomics surveys, a nationwide panel of over one hundred economists, real estate experts and investment & market strategists.

3. The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100 (according to a study conducted and published in June of 2012 by the Federal Reserve ).

No matter where you are in the cycle of homeownership, now is a great time to either invest in your future or cash in the gains from your long term investment.

A look at Denver Real Estate – July 2014

Have you been waiting for the right time to sell your home and move on to the next chapter of your life? Now is an amazing time for you to speak with your REALTOR to determine how much your home has appreciated in value and estimate your net proceeds if you were to sell your home. If you’ve been in your current home for 5 or more years, odds are you need more space, need a more functional home or perhaps are ready to downsize. No matter your situation, now is an amazing time to sell a home in the Denver market. With skyrocketing rents, record breaking first time home buyers, historic low interest rates and a growing population in Denver – multiple prospective home buyers are lined up waiting for homes to buy.

Contact Jennifer Blake today to discuss your real estate needs and questions. When speaking with your Denver REALTOR be sure to ask how they will differentiate your home to maximize your profits and the types of tactics and strategies they use to achieve your goals – whether that’s a door to door move, quick close or selecting the best buyer.

A Look At Denver Real Estate – June 2014

Understanding market value vs what the market will bare

Denver is still in a strong sellers market which is causing challenges for sellers to obtain their true maximum sales price. With inventory at all time lows and multiple qualified buyers for every available house for sale, the market is running into issues with agreed upon purchase prices over appraised values. So what’s the problem with this, you may ask? Well if a buyer is financing the purchase of a house they are only allowed to finance based on the appraised value, not on what the buyer is willing to pay. For sellers, it’s important to find out the realistic market value of their home before listing and have a contract strategy in place so you don’t suffer from losing out on a purchase price that buyers may agree to in the beginning. For buyers, you too should have a realistic idea of market value before making an offer and a strategy in place in the event your agreed purchase price is above the market value.

I’ve recently been on both sides of this scenario representing sellers and buyers. When handled properly in the beginning everything works out smoothly. But, given current market conditions and subjective appraisals be sure to discuss this situation with your Denver REALTOR before submitting or accepting an offer.

A look at Denver Real Estate – May 2014

Home values rapidly rising

There is no question the Denver Real Estate market is heating up quickly this year. Median sales prices have risen approximately 10% from March 2013 to March 2014 and the number of homes sold month over month compared to last year is pacing nearly 50% higher. At the end of April there were 22,871 home sales in metro Denver compared to 15,542 in 2013! Demand is skyrocketing from first time buyers, relocations to the area, boomerang homeowners who lost their home to foreclosure or short sale several years ago are able to qualify again and existing home owners who have been holding on waiting for values to rise.

It’s an amazing market for sellers but I’m not going to lie, it can be a little scary for buyers. If you’re a current home owner thinking of selling be sure to talk through strategies with your agent for a door to door move, sometimes it works out best to go into temporary housing but it’s not always necessary. If you’re a buyer be sure your agent is utilizing tactics to help your offer stand apart, a strong offer extends far beyond the purchase price.

If you’ve been thinking of buying or selling a home in the Denver area contact me to discuss your situation and develop a plan customized to your needs. Find out the services I offer to assist my sellers earn more money in less time and my buyers increase their odds of having their offer accepted in multiple offer situations.

-Jennifer Blake, Denver REALTOR

A look at Denver Real Estate – April 2014

The year of first time buyers

According to a recent report from the National Association of Realtors (NAR), Millennials now account for the greatest market share of recent home purchases. 74% of Millennials view now as an excellent or good time to buy the things they want or need.Now is a great time for first time buyers, especially in Denver where it’s currently 43% cheaper to buy than rent as reported by the Denver Post and fantastic financing programs are available such as Neighborhood Lift, Metro Mortgage Assistance Plus, Mortgage Credit Certificate and CHFA. There is no question there are many advantages of owning over renting.

If you’ve been thinking of making the move to home ownership, I’m here to understand your goals, provide professional service and assist in preparing you on a successful path to owning your home. Jennifer Blake, Denver Realtor®

A look at Denver Real Estate – March 2014

Demand for residential real estate is still outpacing available inventory. Twice as many homes either sold or went under contract than we saw in new listings between March 7 and March 14. A recent study by LendingTree shows that 71% of homeowners are thinking of selling in 2014. Also, twice as many first time buyers are expected to enter the market in 2014 compared to 2013. What does this mean? With the increase in property values and confidence in the market there should be extensive activity happening in 2014. We are still in a sellers market, but perhaps we will see the market even out by the end of 2014.

Demand for residential real estate is still outpacing available inventory. Twice as many homes either sold or went under contract than we saw in new listings between March 7 and March 14. A recent study by LendingTree shows that 71% of homeowners are thinking of selling in 2014. Also, twice as many first time buyers are expected to enter the market in 2014 compared to 2013. What does this mean? With the increase in property values and confidence in the market there should be extensive activity happening in 2014. We are still in a sellers market, but perhaps we will see the market even out by the end of 2014.

A look at Denver real estate – Feb 2014

Denver’s real estate market hit it’s turning point in late 2011 when demand began to increase, supply (number of active listings) began to decrease, resulting in rising sales prices. As seen in this chart, inventory in the Denver metro is currently at it’s lowest point in 5 years and the average sales price has increased by more than $60,000 or 26% in the past 2 years. We are currently in the perfect storm for both home buyers and home sellers.

For current home owners in Denver, this is excellent news as your home has appreciated in value. If you’ve been waiting for the market to strengthen to increase your equity position in the sale of your home, there won’t be a better time in the foreseeable future to make a move. Inventory is at record lows and demand is high with buyers lined up for great properties to hit the market.

For soon to be home owners in Denver, buying now will allow you to afford more house for the money. Home values are at seasonal lows and will only increase over the next several years. Mortgage rates are also still near historic lows with experts predicting rates to rise a full point by the end of 2014. What this means in numbers is principle and interest rate payments on a $200,000 loan today (4.5% interest rate) are comparable to a $180,000 loan expected this time next year (5.5% interest rate). In other words, now is an excellent time to buy low to begin building your equity and sell high!

No matter where you are in the cycle of home ownership, I’m here to offer resources and keep you informed to make educated decisions related to your greatest investment.

Jennifer Blake, Denver Realtor® – Call/text/email 303.842.2306 or jblake5280@gmail.com

Neighborhoods – Urban

Central

- Bonnie Brae

- Capital Hill

- Cheesman

- Cherry Creek

- Congress Park

- Cory Merril

- Denver Country Club

- Lowry

- Observatory Park

- Platte Park

- University Park

- Wash Park

North

- Berkeley

- City Park

- Clayton

- Cole

- East Colfax

- Five Points

- Globeville

- Highland

- Jefferson Park

- Lincoln Park

- Park Hill

- Sloans Lake

- Stapleton

- Sunnyside

- Uptown

South

- Athmar Park

- Baker

- Cherry Creek Country Club

- Cherry Hills

- Glendale

- Harvey Park

- Mar Lee

- Ruby Hill

- Southmoor Park

- University Hills

- Virginia Village

- West Colfax

- Wellshire

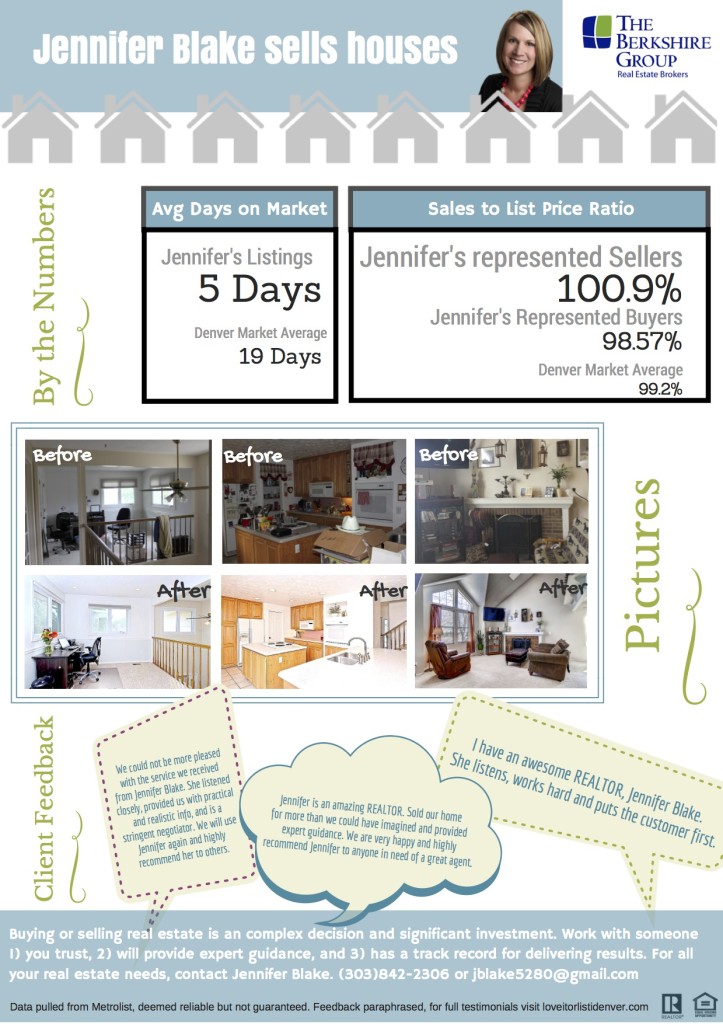

Experience the difference

Many agents will be able to successfully sell your home, but few will provide a full service plan to maximize your homes net worth to prospective buyers. Your homes value is largely determined by the market, but there are a number of ways you can increase the perceived value and create a competitive advantage over other homes actively for sale. For your complementary consultation and to learn more about your homes potential contact Jennifer Blake today!

Case study:

How sellers lived in their home compared to following the staging process – working only with what they already had.

Neighborhoods – Suburban

North

- Arvada

- Brighton

- Broomfield

- Golden

- Henderson

- Lakewood

- Northglenn

- Thornton

- Reunion

- Westminster

- Wheat Ridge

South

- Aurora

- Castle Pines

- Castle Rock

- Centennial

- Columbine

- Englewood

- Greenwood Village

- Highlands Ranch

- Ken Caryl

- Littleton

- Parker

- Roxborough Park

Staging Checklist

Buying a home is an emotional decision and most buyers form an opinion of the property in the first 7-10 seconds. Sellers who want to maximize their proceeds should be open to “staging” their home to remove distractions and neutralize the property to appeal to the largest pool of buyers. Many Sellers will be able to do most of the work for minimal expense, but there will be man hours involved. Sellers who invested $500 on staging recovered over 343% of the cost when they sold their home, according to Homegain.com. Also, According to the National Association of REALTORS (NAR), the average staging investment is between 1 and 3% of the home’s asking price, which generates a return of 8 to 10%.

Prior to marketing your property and beginning showings here are several tips to “staging a house to sell”:

- Curb appeal is the buyer’s first impression of your home. For no money you can tidy up your yard by removing leafs, weeds, pruning shrubs, trimming trees and keeping the lawn manicured. For little money you can create a welcoming entrance with flowers, a freshly painted door and updating outdated light fixtures.

- Kitchen is the heart of the home. For no money you can clear countertops, clean every surface in the kitchen including appliances and organizing the refrigerator and pantry. For little money you can paint tired cabinets – a neutral white or espresso brown with updated hardware currently appeal to the majority of buyers. If your appliances don’t match, it is likely going to be worthwhile to replace the mismatched look with consistent pieces – all stainless steel appliances or all white appliances for example.

- Bathrooms are critiqued closely by buyers. For no money you can scour each bathroom, making them shine and nicely display a plush matching set of towels. For little money consider replacing the vanity and faucet, add molding around the mirror and replace old caulking around the tub to give the bathroom an updated look.

- Neutral color pallets should be used throughout the home; there may be rooms that would benefit from a fresh coat of paint. Having difficulty selecting the right color, here are several of Sherwin Williams most popular colors: Sea Salt, Nimbus Gray, Agreeable Gray, Popular Gray and Revere Pewter.

- Make sure floors are in good condition. If flooring is worn or stained it may be worthwhile to refinish or replace – consult with your REALTOR before investing in new flooring, the return will depend on market conditions and the property’s price point.

- Pack up the clutter, remove distractions, possibly re-arrange or eliminate furnishings and artwork. Not sure on this, consult with a professional.

- Clean. Clean. Clean. Declutter. Declutter. Declutter. Clean. Clean Clean. If you have the time and you enjoy cleaning then scour from top to bottom, most prefer to use a professional cleaning service right before the home goes on the market.

If you’re reading this because you’re selling, the purpose is to only take on projects that will yield a return on your investment. DO NOT invest in any renovations before speaking with your REALTOR. Some projects may be worthwhile but this will be property dependent.

Selling your home is an important task. Contact Jennifer Blake for a free evaluation of your home and to discuss the services she’ll include to maximize your profits. I’m here to understand your goals, provide professional service and deliver outstanding results.

Jennifer Blake, Denver Realtor® (303)842-2306